The Peculiar Pricing of Wood Pallets

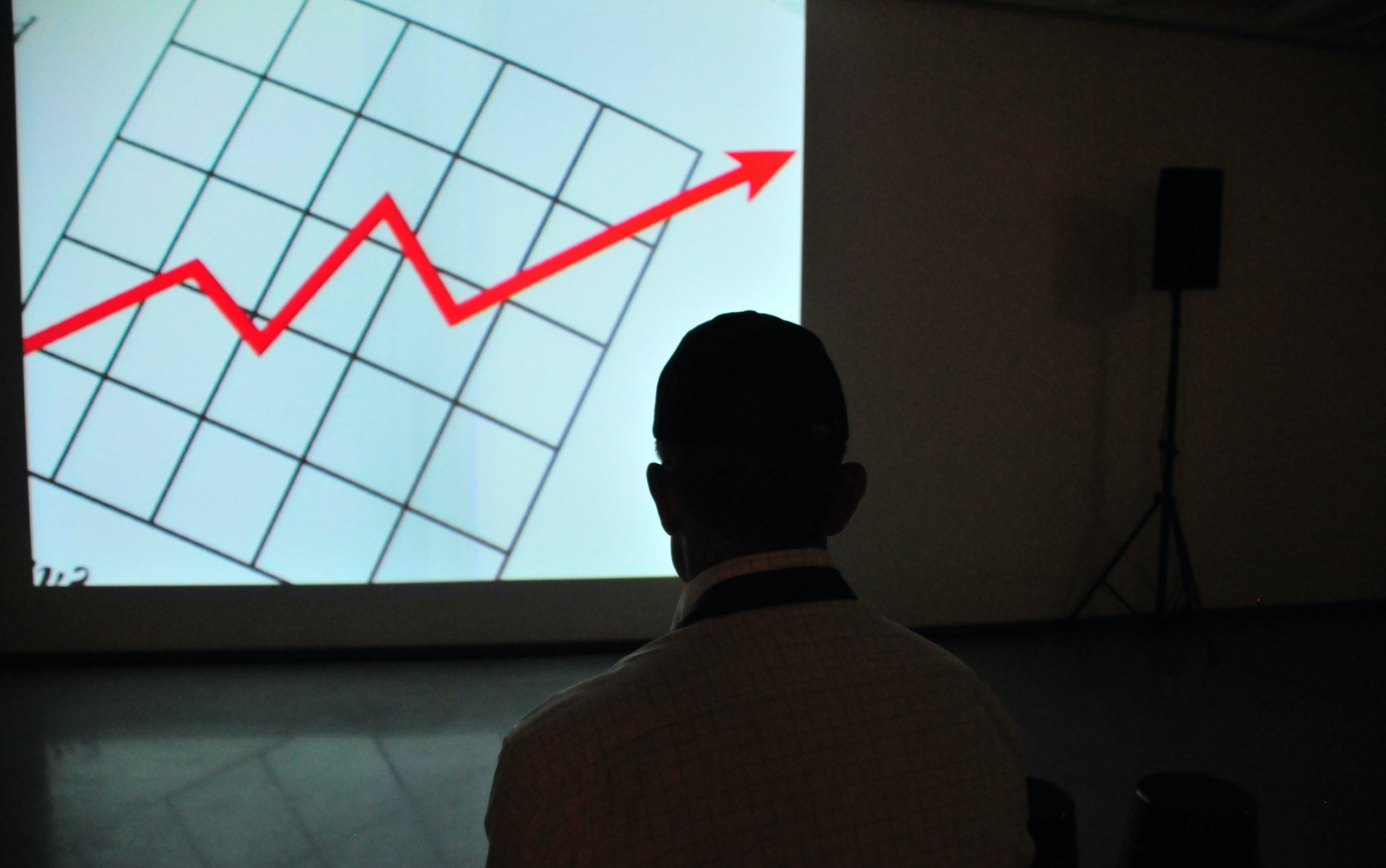

In explaining why wood pallet prices vary, let us look at gas prices as a comparison. Consumers reluctantly accept the upward and downward shifts in prices paid at the gas pump. People understand that gas prices are largely dependent upon the price of crude oil, and so changes in the cost of crude are quickly reflected in the retail price of gasoline. Wood pallets are similar in that much of their cost is also related to another commodity – timber.

Consider that as much as 65% of the cost of a new pallet is directly related to the wood and fasteners used to build it. And given that pallet industry margins are generally very low, it is hard to avoid passing along cost increases. As such, pallet prices are extremely sensitive to the cost of material inputs. Other factors can influence wood pallet prices, including supply and demand, weather, government policies, and more.

Regional Variability for new wood pallets

National pallet buyers quickly come to understand that pallet prices vary across North America. Chances are that the price you pay for a new wooden 48×40 pallet will be different in Arkansas than in East Texas. Variables such as lumber, labor, and real estate availability all play a role.

A quick scan of a recent pallet market report revealed more than an 8% spread in pricing across the country for a new 48×40 wood pallet. Given that material costs are such an important component of wood pallet prices, it stands to reason that geographic regions enjoying access to cheaper wood will be able to produce pallets at a lower cost than in other areas. Regions with proximity to local timber supply can avoid significant transportation costs.

Regional variability for recycled pallets

As for recycled wood pallets of good usable quality (sometimes known, a recent market report showed that they varied almost 25% from the lowest pricing in New England to the highest in the Pacific Northwest. Unlike new pallets, however, the cost of new lumber is not a primary determinant of price.

The regional availability of recycled wood pallets and the demand for them, shape the market. In strong produce industry markets (read: fruits and vegetables), demand for recycled pallets may be very high. The supply of recycled pallets, however, is in large part generated from the consumption of consumer goods.

In larger metropolitan markets, more recycled pallets are generated. In markets where demand is very high, but where population and pallet generation are low, the price can be expected to be higher. On the flip side, a populous region that creates a lot of recycled pallets, but without a strong local demand, can be expected to experience lower pricing.

Seasons and Weather

Predictable wet seasons and extreme events can impact timber and pallet prices. Seasonal wet weather, or events such as hurricanes, floods, or forest fires, can limit access to timberlands, imposing significant challenges to loggers.

Mill investment and optimization

Pallets are made from low-grade or industrial lumber, which is a byproduct of grade lumber production by sawmills. Mills make more money from grade lumber than industrial, so they try to recover as much grade as they can. New softwood mills, featuring technologies such as computer laser scanning, offer significantly improved grade yield. Even though overall production is increasing in the U.S. South, total industrial lumber generation is declining, thus adversely affecting pallet lumber supply, resulting in higher priced material.

Competing and complementary markets for wood

Increased competition for industrial lumber from other sectors such as rail ties or flooring can also result in higher prices. There can also be complementary effects. Stronger demand for grade lumber and increased production can lead to the generation of more industrial lumber, and thus favorable pricing. Conversely, reduced consumption can lead to less industrial lumber in the market, as was the case after Chinese hardwood tariffs contributed to hardwood production curtailments in the Eastern United States.

External shocks: Policy and Pandemic

2020 provides great examples of how government policies and exogenous shocks can impact lumber supply, and ultimately, wood pallet prices. The UK’s decision to leave the EU demonstrates the influence that policy can have on the pallet market. Departure from the EU will mean that all wood pallets moving between the two markets will be required to be ISPM 15 compliant. Many companies have cautiously chosen to build product and material inventories prior to the effective date, thus resulting in increased short-term demand and higher pallet prices in the face of tight lumber supply internationally.

In North America, as industries such as construction ground to a halt during the early months of the COVID-19 pandemic, many mills curtailed production. By summer, however, construction returned, and the new housing market boomed. Due to the mill closures, lumber availability was tight, resulting in historic high lumber prices in the months that followed, until the supply could catch up.

In the final analysis, a new wood pallet, as a timber-based product, is subject to price fluctuation. The good news is that despite price movements, wood remains the most cost-effective and sustainable material available for pallet construction.