Wood vs. Plastic – A Quick Comparison

As sustainability becomes an increasingly important factor for businesses, industry experts are continuously exploring the most eco-friendly packaging solutions. Two of the most widely used materials in packaging are wood and plastic.

In this exclusive Nature’s Packaging blog post, we will compare the environmental impact of wood vs plastic packaging, addressing factors such as production energy, recyclability, and biodegradability.

Production Energy: Wood Packaging Takes the Lead

When comparing the energy required to produce wood and plastic packaging materials, wood emerges as the more sustainable option. Wood packaging production typically consumes less energy and releases fewer greenhouse gas emissions than plastic production.

The lower energy demand can be attributed to the fact that wood is a naturally occurring material, whereas plastic is derived from non-renewable fossil fuels, like oil and natural gas. Moreover, wood acts as a carbon sink, storing carbon dioxide throughout its life cycle, which helps mitigate climate change.

Recyclability: A Mixed Bag of Results

Both wood and plastic packaging can be recycled, but the recycling rates and processes for these materials differ significantly.

Wood packaging, such as pallets and crates, can be easily repaired, reused, and eventually recycled into wood chips, mulch, or particleboard. While the recycling rate for wood packaging varies depending on local infrastructure and initiatives, its recyclability remains a strong point in its favor.

Plastic packaging, on the other hand, presents more challenges when it comes to recycling. While some types of plastic can be recycled multiple times, others can only be recycled once or not at all.

Additionally, plastic recycling rates are generally lower than those for wood, and the recycling process can be energy-intensive, reducing its overall sustainability advantage.

Biodegradability: Wood Packaging Shines

In terms of biodegradability, wood packaging stands out as the clear winner. Wood is a natural, organic material that decomposes over time, breaking down into harmless substances that can be absorbed back into the environment. This process not only reduces waste but also returns valuable nutrients to the soil.

Plastic packaging, however, does not share this advantage. Most plastics are not biodegradable and can persist in the environment for hundreds of years. Even biodegradable plastics, while an improvement, can take years to break down and often require specific conditions for proper decomposition.

Wood Packaging as a Sustainable Choice for Industry Experts

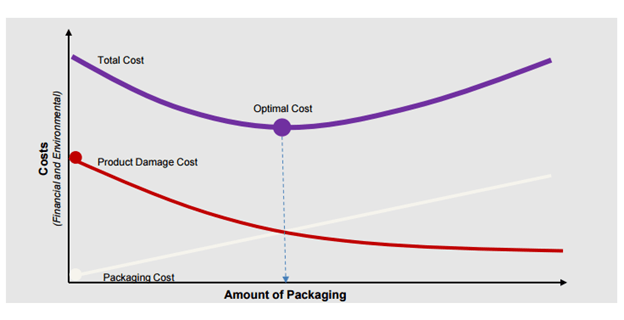

To achieve sustainability goals in the supply chain, we must weigh the environmental impacts of the materials we choose for packaging solutions. This comparison of wood and plastic packaging highlights that wood is generally a more sustainable option, given its lower production energy, recyclability, and biodegradability.

While plastic packaging may offer advantages in terms of weight and durability, it’s essential to consider the broader environmental implications. By prioritizing sustainable materials like wood and encouraging innovations in eco-friendly packaging, we can drive our industry toward a greener future, where the environmental footprint of packaging is minimized, and a circular economy becomes a reality.